The Chambishi disaster highlights Zambia’s vulnerabilities stemming from economic dependency on Chinese investments and crippling debt obligations. On February 18th, a significant failure at Sino-Metals Leach Zambia released approximately 50 million liters of toxic waste into the Mwambashi River, resulting in environmental catastrophe that devastated local water sources, wildlife, and agriculture, ultimately threatening community livelihoods.

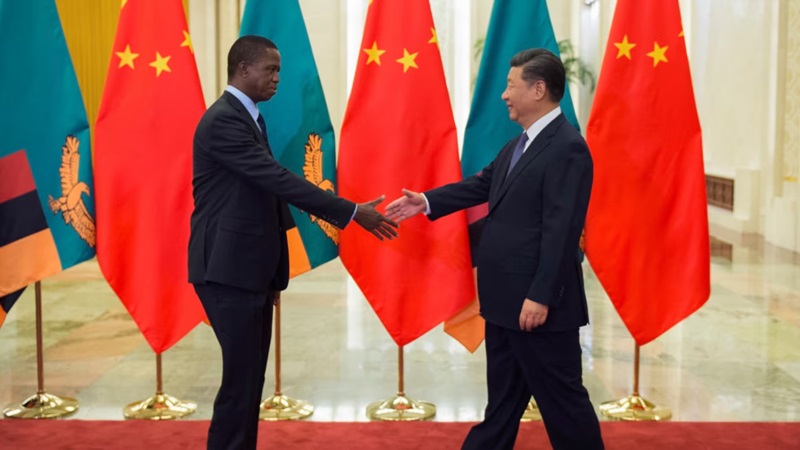

Zambia, heavily indebted to China (over $4 billion), faces challenges in regulating its major creditors, as much of the debt arises from infrastructure and mining projects financed by Chinese loans. Despite being Africa’s second-largest copper producer, this dependency has fostered complacency in regulatory oversight, allowing companies like Sino-Metals to operate with minimal scrutiny and often in violation of environmental and labor standards.

The Chambishi spill and a subsequent worker’s death at another Chinese-operated mine illustrate ongoing negligence. Zambia’s reluctance to enforce strict penalties against Chinese firms stems from fears of damaging crucial economic relationships.

In 2023, Zambia began restructuring $6.3 billion of external debt, with a significant portion owed to China, yet negotiations remain drawn-out due to contested terms. Experts warn that without adequate waste management, further environmental disasters are likely, intensifying local resentment towards China’s practices and perceptions of neo-colonialism.

President Hakainde Hichilema, who has promised accountability, faces pressure to ensure environmental protections while balancing economic interests. His administration has temporarily suspended Sino-Metals’ operations pending investigation, although past inconsistencies have left local communities doubtful.

Similar patterns of environmental destruction and worker abuses can be observed in Chinese operations across Africa, raising concerns about China’s commitment to sustainable development. For Zambia, addressing these intertwined crises necessitates significant policy changes, including diversifying foreign investments and enforcing environmental and labor standards. Ultimately, the nation is at a crossroads, needing to mitigate debt-driven growth’s impact on its ecological integrity and sovereignty.